Is now the best time to buy a house since the great depression? I think so, and after reading through this article I think you may also side on the fact that now is an amazing time to get into home ownership. 2012 has the potential to be the best year for buying a house in over 50 years.

Having been active in my family’s real estate investment business and having worked as a real estate agent in my past I feel pretty comfortable with real estate values, making money with real estate, and the market in general. Since I like to stay active in educating myself on the market, both residential and commercial, I have noticed, at least in my market (I’m currently in Green Bay, Wisconsin) that now might possibly be the best time to buy real estate since about the 1940’s. The end of 2011 and beginning of 2012 remains a buyers market, however, I’m not sure, and nobody can be completely positive, when the market will bottom out.

However, I can say for certain the real estate is cheap, and the strategy of buying low and selling high is what works with investing.

As you read through this article and think about the housing market think about one quote from one of the richest men in the world:

“Be fearful when others are greedy, and greedy with others are fearful.”

-Warren Buffet-

I’m willing to bet that you and I agree, most people are currently fearful. However, articles like this one were commonplace in the mid 2000’s as people literally waited in line to buy condos. If people are waiting in line to buy property, be fearful, be very fearful! However, there are currently no lines, and fear is the order of the day. It’s time to be greedy.

Why Now is an Amazing Time to Buy

Before I get into the reasons let me preface this with the fact that I’ve also recently purchased a bank-owned home simply because I felt so strongly that prices were cheap and the investment potential so great. I truly believe folks who buy smart now, from motivated sellers (banks) will make gobs of money in the future if they hold until the market rebounds.

Reason 1 – Interest rates –

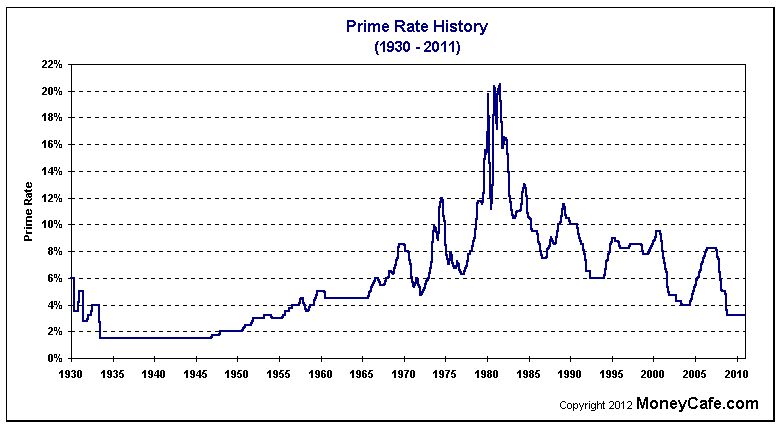

Interest rates are so incredibly low that some may consider this to be practically “free money.” Mortgage rates are below 4% and holding steady. You can pick up a 30 year mortgage at 4%, and never have to readjust or run into the problems that folks did with adjustable rate mortgages. You will save tens of thousands in interest over the life of your loan simply by getting a rate this low, and you’ll most likely never see rates this low for a long time. Check out the graph below which is the US prime rate over the years. This directly correlates with mortgage rates.

Reason 2 – Supply is Much Higher than Demand

Although there may be plenty of people who want to buy homes, the increases in lending standards, and amount of qualified buyers (also known as the market) has diminished causing sellers to reduce prices to attract the few qualified buyers on the market. Increased supply means that fishing for buyers (you) has become harder.

Reason 3 – Bank Owned

Banks have an increased incentive to get rid of properties as soon as possible. Banks aren’t landlords, they’d rather make money on interest payments lending to landlords than be the landlord themselves. That means that the market has a glut of MOTIVATED SELLERS! If you read any real estate investment book, the first thing they’ll tell you about finding a good deal is that you need to find a motivated seller. Banks are motivated, you should be excited.

If you’re going to buy now, buying from a bank is probably your best bet. However, that’s if you’re willing to accept the AS-IS risk and are handy enough to fix up a place.

Check out what Donald Trump has to say about buying homes in today’s market.

The Difficult Part

Although it’s a great time to buy it seems that the most difficult part is obtaining financing. Darling Homes has a nice Q&A that says most lenders will let you borrow 2 to 2.5 times your annual salary, so keep that in mind. With higher down payment requirements and more stringent underwriting it’s been increasingly difficult to obtain financing. Of course this is part of the reason that homes are cheaper to begin with since there is a glut of supply without enough qualified buyers. That means, that many markets have years of inventory (years of inventory = total homes on market divided by homes that sell in a year). I believe where I live there is about three years of inventory on the market, which forces banks to vastly reduce the price of homes if they want to sell in a realistic time-frame to reduce their holding costs and remove houses off their books.

Don’t Let Your Emotions Get in the Way

Emotion, speculation, and irrational behavior is what created the current real estate market and the bubble of 2008/2009. Take a piece of advice from that period in time and play conservative. Only buy if it makes sense, and don’t over-leverage yourself.

The Best time to Buy a House Isn’t Market Dependent

Of course the best time to buy a house isn’t necessarily now, it simply depends on each person. If you have a down payment, are going to live in an area at least five years, and truly want to be a homeowner, now is a great time, but remember that the best time to buy is simply when you’re ready, not when homes are on sale.

If you’re ready to become a homeowner, times have never been better. Shop smart, negotiate, and don’t get emotionally attached. You’ll thank yourself when the market recovers.

Have you recently bought a home?

Do you think now is the best time to buy a home?

Image source respres