Creating a debt repayment worksheet is a great way to get all your debts in one place so that you can easily track them and understand what you owe. It’s nothing too challenging, but a great tool in bringing to light your debts. It’s also one of the first things you may want to do when on your process of getting out of debt.

What is a Debt Repayment Worksheet?

A debt repayment worksheet is simply a sheet that lists your debts and gives details about each particular debt so you can easily compare them.

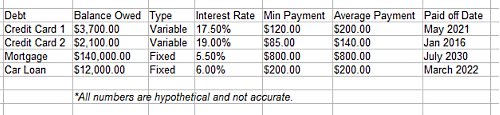

Below is an example of a debt repayment worksheet.

Elements of the Worksheet

We’ll start on the left column and work our way right from the image above explaining each element of the debt repayment worksheet. Each of these elements are optional, but personally I like to have as much information as possible so I’d recommend keeping them all.

Debt – This is simply the lender or debt type that you’re holding, such a car loan, credit card, or mortgage.

Balance Owed – This is how much debt you currently hold with the lender.

Type – Is this a fixed debt or a variable debt. Fixed debts are something like a car payment or mortgage with a monthly amount that does not change. Variable debts are debt balances that change often, which then change the monthly payment. Credit cards are great examples of variable debts because they are constantly changing.

Interest Rate – The interest rate is how much you’re paying on your debt to carry your debt. Each contract you enter with a creditor should have this in writing. If you’re unsure of your interest rate your can contact your particular lender directly to find out. Typically the higher the interest rate, the more likely you should pay off that debt faster since it costs more to hold.

Minimum Payment – This is the minimum balance due by the debt on any billing cycle without receiving late fees. Typically credit cards have minimums while debts like mortgages don’t.

Average Payment – An average payment is simply how much you pay, on average, towards that debt on any given period (typically monthly). If you’re unsure of your average you may want to look back at your last 12 months of payments and calculate one.

Target Paid off Date – This is the date you’ll have your debt paid off at it’s current average payment. If you’d like to have your debt payed off sooner you’ll have to make adjustments on your average payment.

Create a Debt Repayment Worksheet for Free

The image above was created using free software from open office. It’s much like Microsoft Excel, but you can download it for free and use the spreadsheet application to create your very own debt repayment worksheet.