What if you didn’t go to college, but instead invested in your retirement with your would be college funds? How would your financial picture look, and would you be better off financially in the long run?

How much does college cost?

It really depends what part of the country you’re in, but estimates for public range from $7,000-$9,000 a year, while private runs $25,000 and up. Of course, this is simply tuition, and doesn’t include meal plans, room and board, and other expenses. For a student going to a public school and getting out in four years they’ll have a $36,000 pill to swallow if they haven’t accumulated credit card debt and haven’t worked a job during school.

Needless to say, college is expensive.

What would compound interest do to that amount?

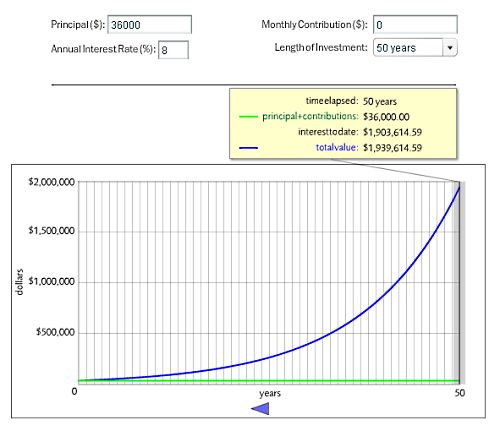

Let’s pretend for a moment that instead of going to college the would be student saves the same amount as what the college tuition would’ve been ($9,000) for four years. That means by the time they’re 22 they have $36,000 saved. If they then invest this amount and don’t touch it until they retire and achieve a market average of approximately 8% they’d achieve a nest egg of over $1.9 million. They also wouldn’t have any debt so they’d just have to pay for their basic living expenses.

Of course the interest rate is something that could be greatly argued, but this is simply a scenario to show you that investing young could set up the student better than going to college. I realize this is highly debatable, but that’s the point.

What would you do instead?

Of course you don’t need a college degree to be successful. You can have a high paying job without a college degree. A college degree is a piece of paper that gives you acceptance by an employer who thinks it’s necessary. However, if you’re ambitious you could work as a freelancer and create your own resume through experience and your portfolio. You could also start your own business and not focus on what a potential employer thinks about your credentials.

To some getting a college degree has become the twenty first century version of getting a high school diploma, if you want a basic job, you’re going to have to get it. However, that’s if you want a basic job.

If you’ve got a degree in philosophy, art, or other liberal arts topics that don’t have much real world application you’re probably not going to earn all that much more than if you just took a job at starbucks out of high school anyways.

There are plenty of jobs out there that simply require an associates or technical degree that pay a lot more because they’re specific and relate to an actual job. Learning about liberal arts may benefit you as a person, but it’s not going to necessarily make you a better accountant, draftsman, or air traffic controller.

I realize college isn’t a purely financial decision, there are other benefits, but for most people who simply go to college to “make more money” I invite you to consider the alternatives including investing young, learning a trade, and avoiding unnecessary debt.

Do you know of anyone who decided to invest long term rather than go to college?

Do you think a four year degree is still worth it when compared to investing and/or getting a technical degree?

Image from smemon

This is a really interesting analysis, Ryan. I think for self starter types who wouldn’t want a typical job anyways, skipping college is a no brainer. Of course, most of these people don’t realize what they want until they’ve been working a few years. Another point is that skipping college will typically exclude you from most super high paying jobs. Banker, attorney, doctor, executive, and the like all usually require a college degree. There is really no simple answer but I think your post makes an important point that going to college should not be something everybody does without thinking… Read more »