So you think you’re ready to get a pad for yourself? Buying a house, for many, is the single largest financial decision of their lives so It’s no surprise then, that this decision shouldn’t be taken lightly. The decision to tie yourself to payments for 15-30 years is huge. As someone who owns several residential properties and purchased their first house at the age of 25, my advice when purchasing your first house consists of the following in order of importance:

- 1. Consider buying a 2-4 unit multi-family building.

- 2. Buy the smallest house you can.

- 3. Don’t buy a house unless you’re going to stay at least 5 years.

- 4. Save for a down payment of at least 10%

- 5. Get pre-approved for a loan before you start shopping.

- 6. Research the neighborhood and comparable homes, learn it like the back of your hand.

- 7. Do not become emotionally attached to any house, no house is “perfect,” negotiate accordingly.

Each of these points are discussed in greater detail throughout this article.

1. Consider buying a 2-4 unit multi-family building.

Wouldn’t it be nice to have tenants pay your mortgage for you? It’s possible if you buy a property for the right terms and you can easily do it as a first time homebuyer. If you buy a building with 2-4 units you still qualify for residential financing and don’t need to get a commercial note! How awesome is that! So if you find a building with four units and your three renters cover all your expenses, you essentially live rent free and your tenants even pay down your loan principal over time.

You may have never considered becoming a landlord, but having 1-3 tenants really isn’t much of a headache. A typical full time property manager can handle about 80-100 units, so that means you’ll spend about 2 hours per month for each unit you own in actual work.

One of the best ways to build wealth is through real estate investing, so if you’re looking at buying your first place consider buying a property with 2-4 units.

2. Buy the Smallest House You Can

Did you know that in 1950 the average new house size in America was 950 square feet? In 2013 that number stood at a whopping 2,598 and the funny part of it is, the number of people living in each house has decreased! I’m not saying you need to live in a cardboard box, but for many of you who’ve lived in dorms in college, or in you parents’ basement, you’re already used to living in small places, so going from a dorm (think 288 square feet) to just under 1,000 square feet should feel like a massive increase!

Did you know that in 1950 the average new house size in America was 950 square feet? In 2013 that number stood at a whopping 2,598 and the funny part of it is, the number of people living in each house has decreased! I’m not saying you need to live in a cardboard box, but for many of you who’ve lived in dorms in college, or in you parents’ basement, you’re already used to living in small places, so going from a dorm (think 288 square feet) to just under 1,000 square feet should feel like a massive increase!

“The Levittown house was a popular model for a suburban home. At just 750 square feet, the homes were relatively inexpensive and ready for mass production. In 1950, the year Time magazine estimated that Levitt and Sons built one out of every eight houses in the United States, the average size of a newly built single-family home was 983 square feet”

–Chicago Tribune–

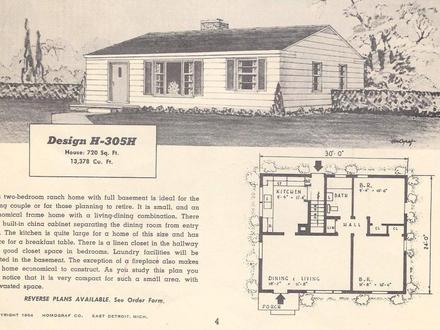

If it’s just you, and possibly a partner without kids you can easily buy a house well under 1,000 square feet and be comfortable. That’s exactly what I did. You can see an image of my house below, which is a 1950’s ranch. My neighbors next door have lived in their similar house since it was built; They’ve retired and have been in the same house their whole lives! My house is 760 square feet, which consists of two bedrooms, one bathroom, a living room and kitchen along with a full poured basement for an extra 760 square feet of unfinished storage space. It was a fixer upper purchased in 2011 for $37,000… Yea, that’s not a typo, it literally cost less than a brand new truck. I was able to pay it off in a little over a year by saving the majority of my income. Later on I used the equity to make a down payment on an apartment building, which pays for my mortgage and more!

How much can you save buying smaller?

You don’t just save money on the price when you buy smaller. Houses are a reoccurring liability with expenses that you would pay every month even if you have it paid off without a mortgage, which is why a house is a liability, not an asset. You can save thousands each year and go on a nice vacations, just by the decreased amount of housing costs. A smaller house means the following, which all save you time and money:

- Less Maintenance Cost (saves time as well)

- Lower Utilities Bills

- Less Taxes

- Lower Insurance

- Less Stuff Needed to Fill it

- Less to Clean (saves time as well)

The ironic part of it all, is that through being money conscious and creating your own freedom, you’re also making a smaller environmental footprint. It’s funny because developers will push “green homes,” but a 900 square foot efficient home will always be more “green” than a new 2,500 giant house.

If you buy a small house that still has an open layout it’ll also make it feel much bigger. I removed a wall in my house which makes my living room / kitchen feel like one big room. I’ve been in houses twice as big, but they’re much more chopped up and therefore felt smaller when you’re in the rooms.

So Why Does Everyone Buy Big?

The short answer is money. It’s in the interest of real estate salespeople, builders, mortgage lenders and everyone else who makes money with homes for you to buy the biggest one so they can make the biggest paycheck. Buying a bigger house doesn’t lead to increased fulfillment or success in your personal life, but does tie you with a lot of debt.

Kill your ego and don’t buy to impress people by staying up with the Joneses. Buy for what’s functional for your budget and your life. Buying a smaller, less expensive home will lower your monthly payments and expenses and give you more freedom!

Here are some other great articles about choosing to live in a smaller than average house:

–NY Times – Living With a Lot Less

3. Don’t buy a house unless you’re going to stay at least 5 years or are 100% sure you can rent it out without hassle and for enough to cover your expenses.

If you’re not sure where you’re going to be even next year, don’t consider buying a house. The reason for buying a house should be that you want to save money versus renting over time. Why would you pay more for owning (in real cost) and yet still have to deal with limiting your mobility and making repairs yourself? The only reason would be emotional attachment to the idea of having a home. If the numbers don’t add up to you winning with owning, then rent, it’s that simple.

Each market is different, some go up, some are heading down, but assuming you live in a stable real estate market with a 1-2% appreciation rate, it’s best to plan on living there for at least six years to make it a worthwhile investment. Why’s that you ask? Because if you buy a house, then sell it only a year later you’re most likely going to lose your ass, that’s why. Closing costs and transaction costs are going to make you regret you sold so soon. Two examples are shown below prove the point assuming the house appreciates 2% per year and you don’t do any major work to it. I’m also considering a 30 year mortgage at current rates of 4% when showing how much principal has been paid down.

Selling Your Home - 1 year vs 5 year

| Time Owned | One Year | Five Years |

| Value | $102,000 | $110,408 |

| Minus Loan Remaining | $78,591 | $72,358 |

| Equity Remaining | $23,409 | $38,050 |

| Minus Cost to Sell (7%) | $7,140 | $7,729 |

| Minus Original Down Payment ($20,000) | $20,000 | $20,000 |

| Gain / Loss | (-$3,731) | $10,321 |

As you can see, after one year you’re going to lose thousands of dollars. The only way to avoid this is to have a market increasing at a very high rate, or to eliminate transaction costs by being able to sell your house without real estate agent fees, both are hard to accomplish. The longer you stay in the house, the more likely you will gain over time.

I know some of you are thinking that prices may grow faster, or that they may even drop, but historically housing has been relatively stable. Knowing that you’re going to be staying longer also allows you to ride out market cycles so you don’t get stuck having to sell your house for less than you paid.

4. Save for a down payment of at least 10%

No money down typically means a ton of risk. You should be confident enough on your decision to be willing to put some skin in the game. If you’re not confident putting your own money into the house do you think it’s a good bet?

5. Get pre-approved for a loan before you start shopping.

If you don’t know if you can get a loan, it’s pointless to jump down to the next steps. Go talk to lenders and see what kinds of loans they’re willing to give you. My advice here, if they pre-approve you for large amounts, simply ignore it. Again, go back to the first point of shopping for small houses, ideally under $100k in price (obviously this depends what market you’re in). If you’re doing this right, you’ll be spending way less on a house than you’re pre-approved for.

6. Research the neighborhood and comparable homes, learn it like the back of your hand.

Success is where preparation and opportunity meet.

-Bobby Unser-

Hopefully at this point you’ve decided to live in a multi-family or small house for all the reasons listed above, and that you are sure you’ll be living there for at least five years, and you’re not pre-approved for a financing. It’s time to start researching.

The biggest question to ask yourself:

-Where am I going to live? This may seem like a joke, but if you give yourself a definite area you’re searching in it makes it much easier to stick to homes in that area. So you need to answer the question where, before you start looking at houses.

Things to consider:

-Your commuting time.

-Is the neighborhood getting better, or getting worse?

-Are houses appreciating or depreciating over the last 10 years?

-What are comparable homes selling for?

-Are you willing to build sweat equity by buying an “ugly” house?

Once you find a neighborhood you’re comfortable with and is in your price point research every house that has sold their over the past two years. You’ll start to see the value of houses as your research and once you see something that looks like it’s considerably less than the comparable homes on the market, be ready to pull the trigger quickly.

7. Do not become emotionally attached to any house, no house is “perfect,” negotiate accordingly.

“To win a negotiation you have to show you’re willing to walk away. And the best way to show you’re willing to walk away is to walk away.”

-Michael Weston-

If a house is the biggest purchasing decision of your life shouldn’t you focus on negotiating the hardest for this one purchase? That’s why point #6 is so important. You know value, so find a seller who is motivated and negotiate downwards. The worst they can say is no, but if you start too high you may have lost out on thousands of dollars in saving. Always aim lower if possible, depending on market conditions.