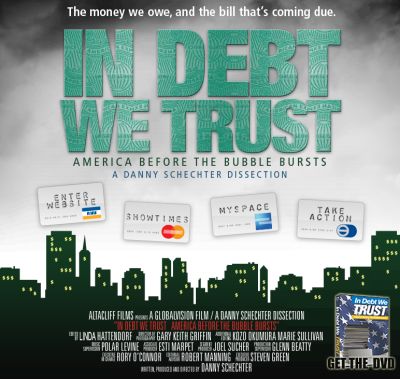

Last night I watched a documentary about credit cards and debt that was produced in 2005 known as “In debt we trust.” The documentary was free to watch on hulu and spent about an hour and a half discussing what credit cards were, the corruption of the system, and the problems we face with debt as a nation. In the film, Danny Schechter interviews bankruptcy lawyers, folks who were in massive credit card debt, and politicians. There were several issues that were brought up the documentary which still remain prevalent today such as…

Can we Live Without Credit Cards?

Danny asks, is it possible to live without credit cards? Can you go through your daily life without making a credit card transaction? This would be difficult if you’re going to be purchasing anything online or if you want to book airline tickets. Where would you even go to purchase airline tickets for cash?

Throughout the documentary there was a lot of forewarning and allusion to a future market crash, which I found to be interesting considering it was produced in 2005. Apparently nobody was watching this documentary back then.

Who’s to Blame for our Debt?

Danny interviews quite a few folks in the movie that are suffering from credit card debt. They include college students and families alike. However, the one thing that’s repetitive through the film was that the credit cards are 100% the bad guys. I can see how credit card companies can be painted in that light, but there was one problem I had when discussing the issue of responsibility.

There was almost no mention of personal responsibility from the consumer and acknowledgment of the fact that the credit card companies are not forcing you to use their product. Granted they’re super aggressive with their marketing, but they are not forcing you to do anything.

Credit Cards and College Students

Mixing credit cards and most college students is a recipe for financial distaster. That’s why I liked the advice of one of the speakers in the film who said this about students and credit cards.

“I think every student should get a credit card, if parent’s won’t co-sign and they don’t have a verifiable source of income, it should be capped at $500 and then raise $500 more each year if the student isn’t delinquent.”

There were also some clever jingles, knocks on the credit card companies, and lines such as:

“there’s some things money can’t buy, for everything else there’s 29% interest.”

However, if you’re already fairly seasoned at personal finance you won’t find anything shocking about anything said in the film. As a nation we have lots of credit card debt, it’s causing lots of people to go bankrupt, and credit cards are evil, seem to be the overall notion of the film. I agree with Danny and think it’s a good thing he made the film, but for someone like myself it’s a bit of same ol same ol.

Easier to Get Into Debt Now More than Ever

During the film one of his interviewees mentions that it’s easier now, more than ever to get into debt. She notes that decrease in real wage, increase in real costs, and lagging public policy are the issue for increasing debt. I agree slightly, but also feel it’s an inability to adapt and a connection to a standard of living that isn’t realistic that’s causing many Americans to go into debt.

Are we Serfs?

The connection between the average American family and serf life of the past was made in the film.

“Where do you want to live, and what bank do you want to use, other than that you don’t have much for choices.”

This seemed to continue the draw of negativity which loomed over the documentary and never focused on how people could lift themselves up out of poverty of fight credit card debt. Americans do have to work, and they do have to choose their banks (if they want to use one), but Americans are not serfs who are powerless to their actions. They have the ability to do whatever they’d like, education themselves, and increase their earnings. We all have to work to provide for our families and serfdom seemed like quite a bit of a stretch.

A Declining Nation

David walker, controller general of the U.S. in 2005, compared the USA today to Rome before its decline by saying:

“Continuing on this unsustainable path will gradually erode if not suddenly damage our economy, our standard of living, and ultimately, our national security”

I see his point and believe that we should, as a nation decrease our spending substantially otherwise bear the burden of eroding our wealth.

Final Thoughts

We have a lot of credit card debt in America. The rich get richer and the poor get poor, which isn’t exactly a new concept. However, the shrinking middle class and amount of people facing economic uncertainty pours more salt onto the wound. I hope, however, that we as a nation take responsibility for our own actions, lift ourselves up, and continue to prosper as a nation that innovates and challenges through adversity rather than spending our time focusing on the latest accessories at the mall.

I would only recommend watching “In Debt We Trust” if you’re unfamiliar with the current credit card situation in America.

In debt we trust at hulu

This would be difficult if you’re going to be purchasing anything online or if you want to book airline tickets. Where would you even go to purchase airline tickets for cash?

Yes. use your debit card

.-= L. Marie Joseph´s last blog ..The trouble with being a First Generation White Collar =-.

Ah, i have seen this. Dave Ramsey had a quick cameo on it. I’d like to turn back the clock. Remember the days when you had to prove yourself worthy of a loan? Now, they are just given away. “Oh, you only make $20k a year? Ok, here’s $500,000 approval letter for the home of your dreams.” And people have no idea what credit cards are all about. They think it’s magic money. Yeah, that $50 item you charged will cost you MUCH more if you make the minimum payments. From speaking to someone who works as customer service for… Read more »

I’ve wanted to see this. Was trying to get this from the library, but it’s always checked out. Another good one is Maxed Out. For the 54 million with an average of $9K in credit card debt, I think it’s about time we start considering that question carefully…can we live without credit cards.

Thanks for the tip.

I haven’t seen the documentary, but I would like to comment on the access to education regarding credit cards. In 2005, it was practically non-existent, which is why the credit bubble burst in 2008. Anyone could get access to credit and some people would go as far as to lie about their current financial status in order to get access to that credit. A recent law was passed that now forces credit card companies to show the effects of interest/paying the minimum payment has on your ability to actually pay off your debt. But that is just one small step.… Read more »

I didn’t watch this documentary but from your blog it sounds really interesting. I’ll have to see if I can find it somewhere online.

I agree with all of the points you make here, usually I read blogs like this and feel the need to argue my own point! But yes I agree, well done!

.-= Harriet´s last blog ..Write Off Debt =-.

A lot has changed since 2005. The debt crisis has reached epidemic proportions. What’s important to understand is that debt is money since 1971 as President Nixon took the US of the gold standard.

Every dollar in your pocket is actually debt. The questions is how you use it to your advantage. Debt is a financial instrument and can be used to build wealth or to stay poor.

.-= Thomas Herold – Financial Educator´s last blog ..Three Mistakes to Avoid With Your Investments in 2011 =-.

I have gone through multiple nightmares with credit cards. I finally paid all mine off and then had to pay off my partners! haha, they’re all gone now and I ain’t getting any more. kthx! 🙂

btw.. please update your commentluv plugin!

.-= Andy Bailey´s last blog ..It’s Snow Joke! =-.

[…] I mentioned that I watched “In Debt We Trust.” I think it’s worth your while watching it, but a fair amount of it was spent […]